According to MIND, the mental health charity, “it is difficult to disentangle the inter-relationship between debt and mental health, but the links are clear. Being in debt can negatively affect a person’s mental health while living with a mental health problem increases the likelihood of falling into debt”.

Understanding how our brain works

In the early 2000’s I realised I needed to try and understand how we could possibly help people with serious debt issues to deal with stress as well as helping to develop a strategy for dealing with their debt. I worked with a psychotherapist Sue Smith (who is now a practitioner with the NHS and also counsels privately at Cheshire Therapy Service) to help develop an understanding of how stress affects individuals and strategies that could help them “literally put one foot in front of the other” and eventually get control of their finances.

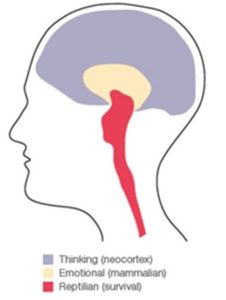

Sue explained to me in laymen’s terms, that we have a logical brain and primitive or reptilian brain as detailed below.

The term “reptilian” refers to our primitive, instinctive brain function that is shared by all reptiles and mammals, including humans. It is the most powerful and oldest of our coping brain functions since without it, we would not be alive. There is a very interesting article “Reptilian Coping Brain” which explains how our reptilian brain controls functions including:-

- Survival – the number 1 job of our brains. This protects us from outside threats and helps us adjust or adapt to life changes and challenges. This is vital for keeping us alive and kicks off an automatic response to protect ourselves.

- Attack or hide response – Humans and all other vertebrates have two instinctive ways to defend themselves when threatened or injured. These are either fight or to flee or hide referred to as our “Flight or fight” response.

- Aggression – showing you are stronger or more mean by using aggressive behaviour. An example is children starting fights in the playground or being a bully who threatens and hurts other kids. This generates fear for those who are the subject of the bully.

- Anger Display – When we display anger we are not only frightening others, but also preparing ourselves for battle. Anger increases blood pressure, heart rate and releases stress hormones into our brain and body to prepare for either attacking of hiding (running away). Humans often get angry when their feelings are hurt, but they don’t know why. A good way to remember this part of our coping Brain is to add “D” in front of “anger.” This is how reptilian survival brain causes us to show anger when we fear we’re in D-ANGER.

- Fear – Fear is an instinctive, primitive response to help us to avoid threats, injuries or death. We all fear for our lives when we are undertaking something scary such as skateboarding, riding a motorbike, sky diving, etc. When become constantly fearful of specific things we call it a phobia.

- Revenge – is the urge to “get even” with others when we have been injured, threatened or something is taken from us that we value. This frequently leads to even more violence between humans with both parties causing increased harm to each other. This we know can even start wars!! If we don’t learn to control those instincts, they can cause us to hate or attack even particular types or whole groups of people.

- Tribalism and territorial behaviour – the most primitive ways our reptilian coping brain seeks to protect us is joining forces with others, “joining a gang”. College or professional sports teams are examples of how reptilian brain urges us toward tribalism. Reptilian tribalism also strengthens our social identity, by being part of a social group, nation, religion, political party, etc. Another type of territorial behaviour is excluding and criticizing others who are different from us and outside of our group.

- Reproductive instinct – Reptilian brain instincts go beyond our own self survival. They include survival of our kind and species by causing us to select mates and produce offspring like our self. This is why all vertebrates, including humans, tend to mate with their own kind. We have an instinctive urge deep in our body and brain that drives us to duplicate ourselves. We are most often attracted to possible mates with whom we have common qualities or desirable characteristics we admire. This is why we have children more like us when we create our own family.

Logical Brain or Frontal Lobe

This is the most recently-evolved part of the brain and the last to develop in young adulthood. It organizes responses to complex problems, searches memory for relevant experience, adapts strategies to accommodate new data and guides your behaviour. It also helps develop kinder attitudes such as empathy and altruism. Stroke in this area typically releases bad language and unsociable behaviour.

Debt Stress and Primitive Brain

The worry and stress of debt can take a very serious emotional and physical toll on our health. The strain that debt puts on personal finances is significant. Average debt levels that we deal with at The Debt Advisor are £30,000. Based on minimum payments of 3%, this means that around £900 is needed monthly to cover minimum payments. This figure could be higher if the debt includes high interest loans and credit cards.

Thinking about not being able to meet your monthly bills (including debt payments), the danger of losing your home and the shame of having incurred serious levels of debt, will plunge your primitive brain into the flight or fight mode. Thinking the body needs extra resources to meet a physical challenge, the brain signals the adrenal glands to release a hormonal brew consisting primarily of adrenaline and cortisol. The adrenaline causes the heart to race, which elevates blood pressure and boosts energy reserves. The cortisol preps muscles for bursts of speed by telling the body to dump glucose (sugars) into the bloodstream. It also diverts energy from the immune, digestive and reproductive systems — any bodily function not essential to a quick escape.

That’s fine, even useful if the stress lasts a few minutes and helps you to escape from physical harm. But when the body is trapped for days, weeks or even months in fight-or-flight mode, adrenaline and cortisol are chronically elevated, a condition that suppresses metabolism, promotes inflammation, and can cause or exacerbate a host of health issues, ranging from heart disease to diabetes to infertility.

Essentially, our brains go into emergency mode. That can undermine our ability to think clearly, and it can also trigger cravings for self-soothing comforts like chocolate biscuits, alcohol or cigarettes — anything that triggers the brain to release feel-good chemicals, such as opioids which are drugs that relieve pain.

Equally damaging debt stress can cause people to cut back on helpful behavior such as spending time with friends, buying fresh produce instead of processed foods, exercising and getting enough sleep. These are all vital actions that keep us well and healthy in the medium and long term.

Getting Logical Brain to take over

There are many strategies that can help reframe how we think about and cope with stress, anxiety and the causes such as debt. Often referred to as “reframing” this is about getting us to think differently which will help us to behave differently. For example, we are fed that designer shopping; if we buy the right things, we will feel happy and not feel sadness or despair. Actually, the high is short lived and often followed by anxiety when we realized how much money we have spent, how much debt we have incurred and how senseless this purchase was.

Debt is the most essential reframing opportunity. Realising that we have a serious level of debt can be a serious awakening bell and can be the impetus for significant change in our lives.

E + R = O

Sue Smith introduced me to a very helpful strategy. E +R = O.

E = Event

R = Response

O = Outcome

E is the event. It’s vital to acknowledge when you are in debt that you cannot change the past and undo the debt. E is about accepting that in the past we may have behaved in a less than sensible way which has given rise to the debt. But beating yourself up about this is senseless. E is also accepting that the debt exists and has to be to dealt with.

R is your response. Developing a response that will deal with your debt is vital. I always chat to people about developing their macro and micro plan.

Macro Plan

The macro plan or response is about developing a strategy to ensure that your debt is paid off in a reasonable period of time. Whether this is bankruptcy, a debt relief order, an Individual Voluntary Arrangement, debt management, or dealing direct with your debt, there is a solution.

Micro Plan

The micro plan is about doing positive every day which makes you feel better. A good start is de-cluttering – getting your paperwork in order, developing budgets, putting controls in place so you can live within your budget. Other micro activities include activities that increase your feeling of well-being such as:

- Get out of bed and your bedroom and tidy up your house

- Make an effort to chat to friends and family.

- Go for a long walk, run, get to the gym. This gets you breathing and releases vital endorphins which make you feel better.

- Have one good coffee in the morning – it can be good for your brain

- Drink plenty of water – our brains are 70% water and need to be hydrated

O is your outcome. O is the most vital part of your plan. This is identifying where you want to get to. Do you want to get debt free, get rid of stress associated with debt and get your finances back under control? If yes than you know you need to develop your R to get to your O.

And finally dealing with your debt

We have a great rescue culture in the UK which can help you develop strategies to get debt cleared in a reasonable period of time. For example Bankruptcy could have your debts cleared in a year especially if you have no surplus money to pay to your creditors and you do not have assets at risk. The process for making yourself bankrupt has become easier with on-line applications taking the place of going to court to present your petition. Visit our information on Bankruptcy for more information.

If however, you have a property and repaying your debt is likely to take more than 10 years, an Individual Voluntary Arrangement or an “IVA” can help you make affordable payments for 5 years. In the 5th year you do have to look to refinance your property if you have a certain level of equity, but the IVA is very fair and provides if you cannot refinance you can introduce a lump sum or pay 12 extra contributions instead. Visit our information on IVA’s for more information.

Also, the criteria for a Debt Relief Order has recently changed so that the maximum debt level has increased from £15,000 to £20,000. See our information on DRO’s for more information.

There are also free sources of debt advice which can be accessed via The Money Advice Service which includes free debt management services.

Help

Please note that it is vital to obtain specialize advice if you are struggling with debt issues. The advice on the right rescue solutions will very much depend on your circumstances. All debt solutions have benefits and risks and certain debt solutions could mean your assets could be at risk. Please call our team on 0333 9999 600.